Introduction

In 2026, many Gurgaon (HR26 / HR98) vehicle owners are choosing the

BH (Bharat) Series number plate to avoid repeated re-registration when relocating.

However, there is confusion about whether the application is fully online

or whether HR26 RTO still manually verifies and controls approval.

This guide clearly explains the difference between applying via the online portal

and how the Gurgaon RTO actually processes BH applications.

What Is BH Series & Why Gurgaon Owners Prefer It

The BH Series was introduced by the

Ministry of Road Transport & Highways (MoRTH)

to simplify interstate vehicle movement.

- No need for fresh state registration during transfers

- Road tax paid in 2-year blocks

- Pan-India validity

- Simplified ownership relocation

All applications are initiated through the

Parivahan Sewa Portal.

Applying Through Online Portal (Parivahan)

The online BH application process works as follows:

- Dealer enters vehicle details on VAHAN system

- Applicant uploads required documents

- Road tax auto-calculated (2-year structure)

- Online payment processed

- Application forwarded to jurisdictional RTO

Legal registration provisions are governed under the

Central Motor Vehicles Rules.

At this stage, many Gurgaon applicants believe approval is automatic —

but that is not entirely accurate.

What Actually Happens at HR26 RTO

Even though the system is digital, HR26 Gurgaon RTO performs manual scrutiny before approval.

- Employer verification call

- GST status check

- MCA company record cross-check

- Address mismatch validation

- Tax calculation re-check

In 2026, Gurgaon RTO has become stricter due to misuse attempts,

especially in private employee applications.

Tax structures and policy notices are published via

Haryana Transport Department.

Online Portal vs HR26 RTO – Key Differences

| Online Portal |

HR26 RTO |

| Digital document upload |

Manual document verification |

| Auto tax calculation |

Tax validation & correction |

| Employer certificate upload |

Employer phone/email verification |

| Instant payment |

Approval can take 5–15 working days |

Conclusion: The process starts online but final control remains with HR26 RTO.

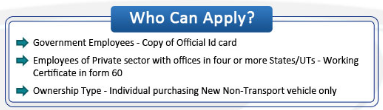

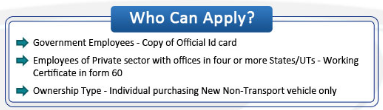

Documents Required in 2026

- Aadhaar (Gurgaon address preferred)

- Form 60 (Working Certificate)

- Employer PAN & GST

- Insurance copy

- PUC

- Form 20, 21, 22

If your vehicle ownership needs correction before applying:

Ownership Transfer in HR26 Gurgaon

If loan endorsement exists:

Hypothecation Removal in HR26 Gurgaon

For interstate movement clearance:

NOC in HR98 Gurgaon

If RC is misplaced:

Duplicate RC in HR26 Gurgaon

Driving license correction support:

Driving License in HR98 Gurgaon

Common Mistakes Gurgaon Applicants Make

- Uploading blurry or incomplete documents

- Using employer without 4-state presence

- GST inactive or mismatched

- Address spelling mismatch

- Incorrect tax entry

Even minor inconsistencies can result in application rejection or file return.

Final Thoughts

In 2026, applying for BH Series in Gurgaon is a hybrid process —

digital submission through Parivahan, but final approval through HR26 RTO verification.

Understanding both sides of the process significantly reduces rejection risk.

Need Help Applying for BH Series in Gurgaon?

Fateh Legacy assists HR26 & HR98 vehicle owners with eligibility review,

document verification and complete BH registration handling.

Talk to our Expert

Frequently Asked Questions

Is BH Series fully online in Gurgaon?

No. Application starts online, but HR26 RTO performs manual verification before approval.

How long does HR26 approval take?

Usually 5–15 working days depending on verification.

Can private employees apply directly?

Yes, if employer operates in at least four states.

Is tax paid annually?

No, BH tax is paid in 2-year blocks.

Can loan vehicles apply?

Yes, with correct hypothecation records.

Are startups eligible?

Only if they meet multi-state presence requirements.

Does HR26 verify GST?

Yes, GST verification is common in 2026.

Is physical visit required?

Mostly online, but RTO scrutiny still applies.

Can second-hand vehicles apply?

Yes, after ownership correction.

Should I take professional assistance?

Professional support reduces rejection chances significantly.