Introduction

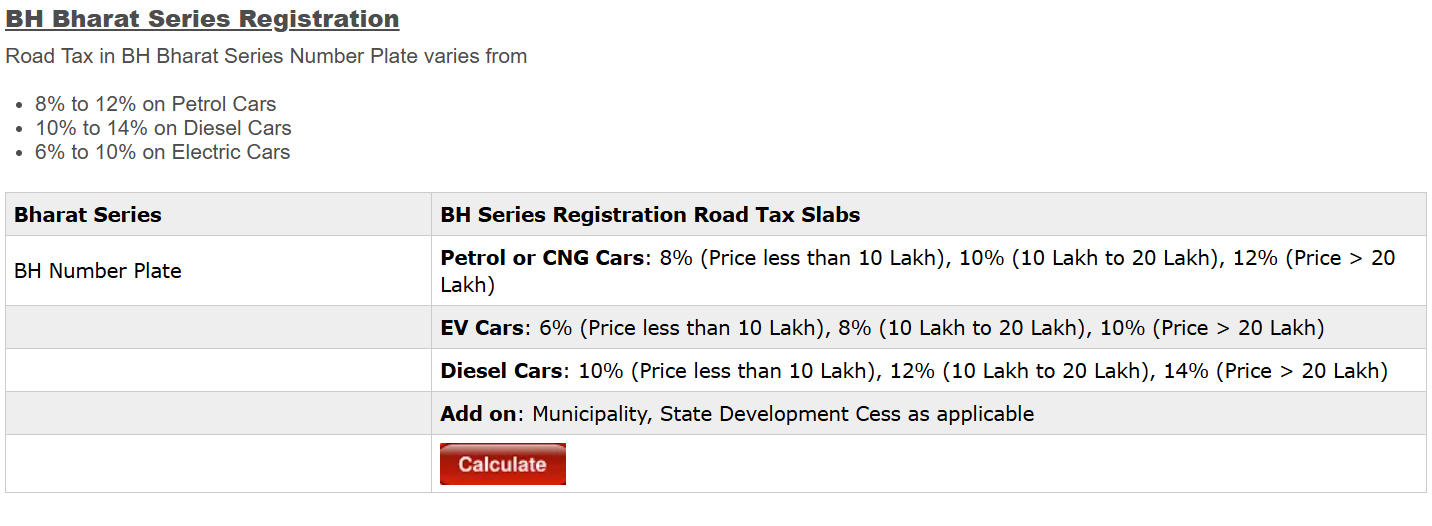

The BH Series Road Tax system was introduced to simplify vehicle ownership for people who frequently move between states. In Delhi, many vehicle owners in 2026 are opting for BH registration—but road tax calculation remains the most confusing part.

This guide explains how BH Series road tax is calculated in Delhi, applicable slabs, what is allowed vs not allowed, and real-world scenarios faced by Delhi vehicle owners. All calculations follow the framework issued by the Parivahan Sewa portal and Ministry of Road Transport & Highways (MoRTH).

If you are new to BH registration, start with: What Is BH Series Number Plate in Delhi? .