Introduction

If you bought your car or bike on loan in Delhi, your Registration Certificate (RC) almost certainly has

a hypothecation (HP) entry in favour of the bank or NBFC. Until that hypothecation is removed, the vehicle is

treated as being under a loan and in 2025 Delhi, that can block you at many stages.

Typical roadblocks include:

- Selling your vehicle in Delhi or outside state.

- Transferring ownership within DL01–DL12.

- Getting NOC, duplicate RC or certain permit updates.

- Claiming a “clear title” while dealing with insurers or serious buyers.

This guide is completely Delhi-specific and updated for 2025. It focuses on:

- How hypothecation appears on your Delhi RC & in the VAHAN database.

- When HP removal becomes mandatory before sale, transfer or NOC.

- Form 35, documents, fees and timelines for hypothecation termination.

- Common rejection reasons in faceless, sticker-linked Delhi systems.

- How Fateh Legacy supports you with HP removal, NOC, duplicate RC and ownership transfer in Delhi.

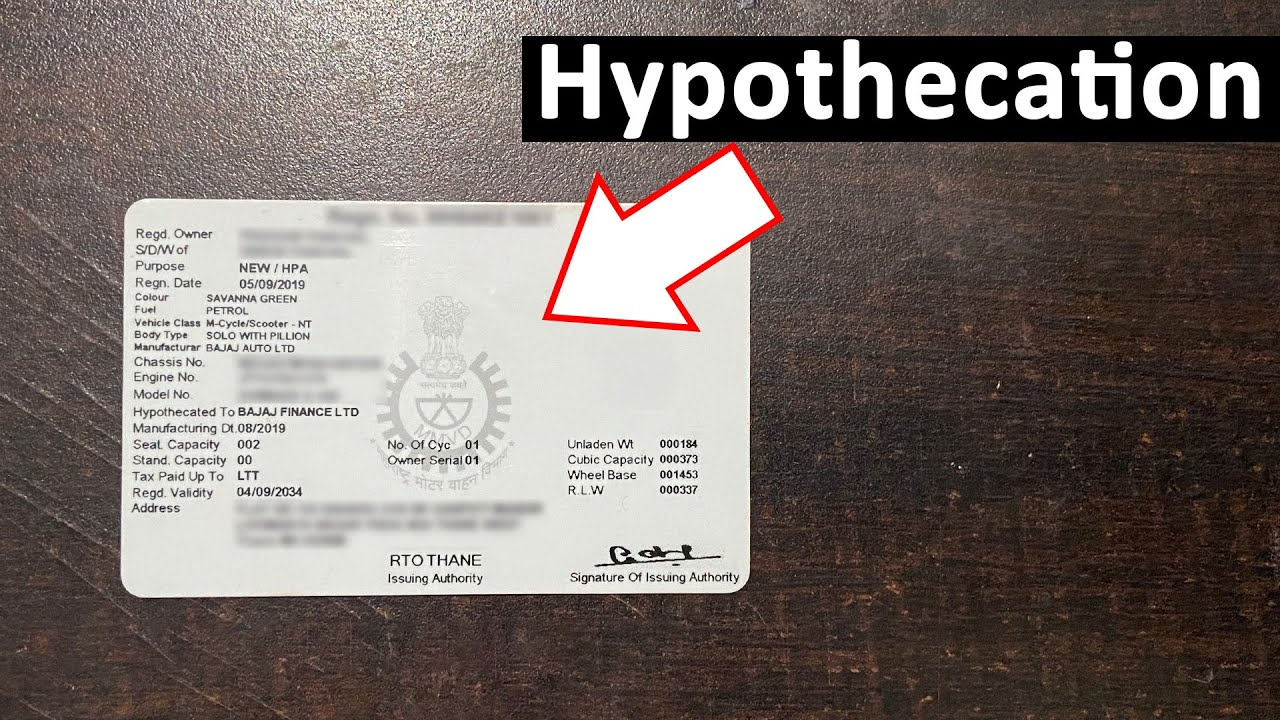

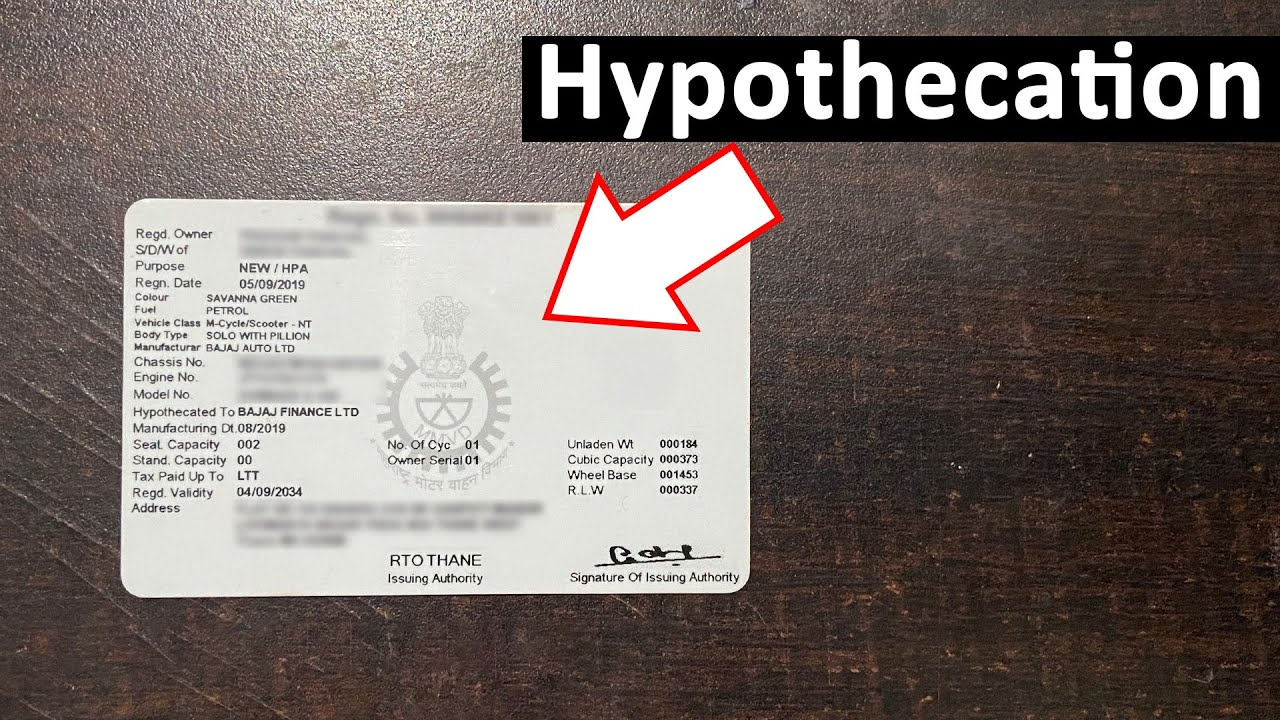

1. How hypothecation works on Delhi RC in 2025

When you take a vehicle loan in Delhi, the financer’s name (bank or NBFC) is added as

hypothecation (HP) on your RC.

- On smart card RCs issued in Delhi, you see a field like “HP: YES / Bank Name” or a specific line mentioning

“Hypothecation – [Bank/NBFC]”.

- This HP entry is also stored in the VAHAN database linked to your registration number.

In 2021, Delhi announced that hypothecation processes would go fully online and faceless, using

OTP-based digital signatures and integration with banks. This transition was reported by

The Times of India

, highlighting that bank approvals and Form 35 could now flow directly into the RTO system.

In practice, by 2025 this means:

- For many major banks, Form 35 is generated digitally and pushed straight to VAHAN / Delhi Transport.

- Your HP status is no longer just a line on the physical RC — it is a core data point in the backend system.

- Any mismatch between bank data and RC data is a common reason for HP removal delays in Delhi.

2. When hypothecation removal is mandatory for Delhi vehicle owners

In Delhi, hypothecation termination is not just a cosmetic change. It becomes practically mandatory in several

real-life situations.

2.1 After loan closure, before selling the vehicle

- Once you repay the loan, you should immediately remove HP from the RC.

- Serious buyers increasingly insist on an HP-free RC before paying full price.

- Dealer sales and online marketplace buyers often treat HP removal as a non-negotiable condition.

India Today’s advisory on selling used vehicles

repeatedly stresses the importance of proper RC transfer and documentation to avoid legal trouble after sale.

Having HP terminated in Delhi is a key part of that clean documentation chain.

2.2 Transfer of ownership within Delhi (DL01–DL12)

For smooth ownership transfer inside Delhi, buyers and agents generally insist that HP be removed in advance:

- Most buyers refuse to proceed if hypothecation is still active on the RC.

- Even if they agree, your transfer timeline becomes longer and more complicated.

If you are planning sale or ownership transfer in an RTO like DL08 Wazirpur, it often makes sense to combine

HP removal with transfer planning. Fateh Legacy supports this via:

Ownership Transfer in DL08 (Wazirpur, Delhi) – RC transfer with clean HP status

2.3 Getting an NOC from Delhi to another state

If you want to permanently move your vehicle out of Delhi:

- Many destination RTOs do not accept RCs with active hypothecation for re-registration.

- In practice, you are expected to terminate HP in Delhi and then apply for NOC + re-registration.

For example, if you are shifting from Delhi to another state and need help with NOC for a commercial or private vehicle,

Fateh Legacy supports NOC-related work through:

NOC in DL09 (Palam, Delhi) – Move your Delhi vehicle legally to another state

2.4 Insurance claims & settlement disputes

In some total-loss, theft or high-value insurance claims, insurers may insist on:

- RC clearly showing no active hypothecation if the loan is closed.

- Proof that bank/NBFC no longer has financial interest in the vehicle.

2.5 To avoid fraud and legal complications

Past fraud cases have involved vehicles being sold as “loan-free” while hypothecation remained active or was

hidden, leading to disputes over ownership and bank rights. Removing HP in Delhi:

- Reduces fraud risk for buyers and sellers.

- Ensures your vehicle has a clean title before any sale or NOC.

3. 2025 Delhi context: faceless, app-based & sticker-linked services

3.1 Faceless hypothecation services

The Delhi Transport Department has rolled out faceless services for vehicle owners, including

hypothecation termination, using:

- OTP-based digital signatures for owners.

- Direct integration with banks/NBFCs to receive digital Form 35 and loan closure details.

- Back-end processing via VAHAN + Delhi e-services portals instead of in-person file movement.

Over time, these services were integrated with Delhi’s online and doorstep delivery systems, so that:

- You can apply from home.

- Applications are processed at the concerned Zonal RTO.

- RCs are delivered by Speed Post in most cases.

3.2 “Super app” & one-stop vehicle services

A national-level “super app” for vehicle services has been highlighted by

India Today, bringing together hypothecation, NOC, tax payment, duplicate RC and more into a single digital

ecosystem. For Delhi owners, this means:

- Easier access to multiple RTO services in one place.

- Better tracking of application status across state and central platforms.

3.3 Colour-coded stickers & access to documents

In 2025, the Supreme Court made it mandatory for Delhi vehicles to have colour-coded fuel stickers for

issuing vehicle documents such as RC, hypothecation updates etc. This development is covered by

Hindustan Times

, which later reported that over 1.2 million vehicles had affixed these stickers.

Practically, if your Delhi vehicle does not have the correct colour-coded sticker or HSRP-compliant plates, you

face a higher risk of delay or objection when you apply for HP termination or other RC services in 2025.

4. Documents required in Delhi for hypothecation removal (HP termination)

Before logging into any portal or speaking to an agent, keep these Delhi-specific documents ready:

- Original RC (smart card / printed RC) in the name of the registered owner.

- Loan closure proof from bank/NBFC:

- Loan closure / No Dues letter.

- Bank’s digital approval if integrated with Delhi Transport / VAHAN.

- Form 35 – Notice of termination of hypothecation:

- Notified under Rule 61(1) for termination of hire-purchase/lease/hypothecation.

- For integrated banks, Form 35 is often generated digitally and transmitted directly to the RTO system.

- Valid Insurance Certificate – listed as mandatory for HP termination in Delhi doorstep portals.

- Valid PUC (Pollution Under Control) certificate – critically important due to Delhi’s strict emission rules.

- Address proof if required for doorstep delivery – Aadhaar, passport, voter ID etc.

- Colour-coded fuel sticker affixed – practically essential now for smooth processing of RC-related documents.

If your RC is lost, badly damaged or details are unclear, it is smart to first obtain a

Duplicate RC so that your ownership and vehicle data are clean before HP termination. Fateh Legacy supports

this via:

Duplicate RC in DL11 (Rohini, Delhi) – If your RC is lost or damaged

5. Step-by-step: Online hypothecation termination in Delhi (2025)

A typical Delhi HP removal journey in 2025 looks like this:

Step 1 – Confirm that your bank has updated loan closure

- Check your bank app or statement to ensure the loan status shows “loan closed”.

- Ask your bank/NBFC whether they are integrated with Delhi’s hypothecation system.

- If integrated, the bank usually pushes digital Form 35 and closure details directly into the VAHAN / Delhi database.

Step 2 – Check vehicle & challan status

Before applying for HP termination in Delhi:

- Check for pending e-challans on Delhi Traffic Police portal or mParivahan.

- Confirm that PUC and insurance are valid on the date of application.

- Any pending challan or expired PUC can cause immediate rejection or objection.

Step 3 – Apply online via VAHAN / Delhi portals

The standard faceless flow, as summarised in various RTO and financial guides, looks like:

- Visit the VAHAN citizen services portal or Delhi Transport’s online services.

- Enter your vehicle registration number and last 5 digits of chassis number.

- Authenticate using OTP on your registered mobile number.

- Select the service: “Hypothecation Termination / HP Removal”.

- Confirm bank details and service type (termination of loan / lease / hire-purchase).

- Upload required documents:

- Loan closure / No Dues letter.

- Form 35 (if not already pushed digitally).

- Insurance & PUC (where required).

- Pay applicable fees online (see section on Fees & timeline).

- Submit the application and note the application number for tracking.

Step 4 – Doorstep service option in Delhi

Delhi also offers a doorstep service model under which an authorised runner handles document pickup and

submission. On the official doorstep portal, HP termination is listed with:

- Government Fees: ₹0 (for the HP termination service itself).

- Service Fees: ₹42.37.

- Tax: ₹7.63.

- Total Doorstep Charge: ₹50.

These charges are separate from RC smart card and postal fees, which are applied when the new RC is printed

and dispatched.

Step 5 – RC printing & delivery

Once your HP termination is approved:

- The RTO updates the VAHAN database, removing the bank’s hypothecation entry.

- A new RC without hypothecation is printed (if you opted for a physical smart card).

- You receive it via:

- Speed Post / courier at your registered address, or

- Pickup via an authorised runner, depending on the service chosen.

6. Fees & expected timeline for HP removal in Delhi (2025)

Exact fees can change with notifications, but as of 2025, Delhi’s official and media sources suggest the

following broad structure:

6.1 Fee components to expect

- HP termination government fee

- For Delhi doorstep service, the portal currently shows Government Fees = ₹0 for HP termination itself.

- However, there can still be RC smart card & postal fees separately, similar to other states where

hypothecation and smart card fees together can be substantial.

- Doorstep facilitation fee (optional)

- Currently about ₹50 total (₹42.37 + ₹7.63 tax) for doorstep handling in Delhi.

- Service agent / consultant fee (if you use a private agent)

- On top of government and doorstep fees, Delhi agents charge their own market-driven service charges.

Always verify the latest fee schedule on the official Delhi Transport Department website before applying.

6.2 Typical timeline in Delhi

While the department does not guarantee a single fixed TAT, in real 2025 cases you can expect:

- Online application verification: 2–7 working days if documents are clean.

- RC printing & dispatch: another 5–10 working days depending on backlog and postal speed.

So a realistic Delhi HP removal timeline is usually around 10–21 days, assuming:

- No pending challans.

- Valid PUC and insurance.

- Bank data correctly integrated and Form 35 properly uploaded.

If your application status does not move for over 30 days, it is wise to:

- Raise an online grievance, and/or

- Visit the concerned Zonal RTO with your application number and supporting documents.

7. Common rejection reasons for HP removal in Delhi (2025)

This is where many Delhi vehicle owners get stuck. In the faceless, sticker-linked Delhi system, the most

frequent rejection or objection reasons are:

7.1 Bank details mismatch / non-integration

- Bank has not pushed digital Form 35 or loan closure yet.

- Bank name in RC does not match the current financer name.

- Wrong or missing agreement number in the system.

Tip: Get a clear loan closure letter and confirm that your bank has uploaded Form 35 / NOC to VAHAN / Delhi Transport.

7.2 Incorrect or incomplete Form 35

- Form 35 not signed by an authorised bank signatory (for non-digital flows).

- Typos in vehicle number or chassis number.

- Only one copy submitted where multiple copies are required offline.

Tip: Cross-check registration number, chassis number, owner name and loan account number on Form 35 with RC and bank letter.

7.3 Pending e-challans or tax issues

- System detects pending traffic challans (Delhi or sometimes other states if linked).

- Road tax or other dues flagged at the backend.

Tip: Always clear e-challans and check for tax dues before any RC-related service in Delhi.

7.4 PUC or insurance expired

Given Delhi’s pollution and safety focus:

- An expired PUC can directly block HP termination requests.

- Invalid or expired insurance on the date of application is another common objection.

Tip: Renew PUC and insurance first. Treat them as mandatory prerequisites.

7.5 Colour-coded sticker / HSRP issues

- After the Supreme Court’s 2025 order, missing or incorrect colour-coded fuel stickers can lead to delays.

- The system may keep your file on hold until sticker and HSRP plate compliance is confirmed.

Tip: Get the correct sticker affixed and ensure HSRP plates before starting HP removal.

7.6 Ownership / identity mismatch

- Owner name or father’s name in bank records does not match RC.

- Address mismatch between RC, bank letter and ID proofs.

Tip: Keep original ID/address proofs ready. In complex cases, obtain a bank letter clearly mentioning the RC details.

8. Best practices for Delhi vehicle owners before & after HP removal

- Plan HP removal immediately after loan closure

- Do not wait until the week you plan to sell your car; give yourself at least a month’s cushion.

- Maintain a “loan closure file”

- Keep scanned copies of:

- Loan closure / No Dues letter.

- Form 35.

- Payment receipts.

- RC – old (with HP) and new (without HP).

- Avoid selling a vehicle with active hypothecation

- Track application status regularly

- Use your application number to monitor whether the file is under process, approved or under objection.

- Double-check the new RC after HP removal

- Confirm that the hypothecation line is removed.

- Verify that engine number, chassis number, fuel type, colour and other details are accurate.

Once HP is removed and your RC is clean, you are in a much stronger position for ownership transfer, NOC

and future documentation. If you plan to sell in Delhi or outside, combining HP removal with a structured ownership

transfer plan through Fateh Legacy can save a lot of time and stress.

For step-by-step support, you can also use our dedicated service:

Hypothecation Removal in DL13 (Surajmal Vihar, Delhi)

.

Conclusion

In 2025, managing a vehicle in Delhi means keeping an eye not just on mechanical fitness, but also on

digital records — especially hypothecation (HP) status in the VAHAN system. A loan that is closed in the bank

but still active on RC can quietly block you from selling, transferring or moving your vehicle out of Delhi.

- Plan HP removal as soon as the loan closes, not at the last minute before sale.

- Keep Form 35, loan closure letters, PUC and insurance ready before applying.

- Watch out for common rejection triggers like bank mismatches, challans and sticker issues.

- Use online VAHAN / Delhi portals and doorstep services smartly to reduce visits and delays.

If you feel stuck at any stage — from bank integration and Form 35 issues to duplicate RC, ownership transfer

or NOC — Fateh Legacy is ready to help you navigate the Delhi Transport maze so that your RC is clean, your

vehicle title is clear and your next move (sale, NOC or upgrade) is smooth and legally sound.

How Fateh Legacy helps with HP removal & related RC work in Delhi

A clean hypothecation-free RC rarely stands alone. In real life, Delhi vehicle owners face a chain of

linked issues: loan closure, HP termination, NOC requirements, duplicate RC, ownership transfer and DL compliance.

This is where Fateh Legacy acts as a structured RTO partner.

With Fateh Legacy, you get:

- Guided support for HP termination workflows – verifying bank updates, documents and application steps

so your file has the best chance of first-time approval.

- Integrated planning for sale or NOC – combining HP removal with ownership transfer in DL08 Wazirpur,

NOC from DL09 Palam and other Delhi RTOs when you move vehicles out of the city.

- Support for Duplicate RC and other RC corrections so that your base data is clean before HP and

transfer work.

- Assistance with driving licence services in DL04 Janakpuri and other zones, keeping both vehicle and

driver documents compliant.

Unsure about HP removal, bank updates, NOC or RC issues in Delhi?

Fateh Legacy helps private owners, fleets and dealers across Delhi with hypothecation termination, Duplicate RC,

ownership transfer, NOC and driving licence services, so you can sort your paperwork without wasting time in RTO queues.

Talk to our Delhi RC & HP Expert

Frequently Asked Questions

Is hypothecation (HP) removal in Delhi completely online now?

Mostly yes. Delhi’s hypothecation process has been declared faceless and OTP-based, with major banks integrated into the system. However, if there are mismatches or complex cases, you may still need to visit the concerned Zonal RTO or use the doorstep service to clear objections.

Do I still need physical Form 35 in Delhi if my bank is integrated?

If your bank is fully integrated with Delhi’s HP services, Form 35 is often generated and transmitted digitally. Still, it is wise to keep two signed physical copies of Form 35 from your bank — they are useful if any system mismatch happens or if the RTO asks for physical verification.

How much does HP removal cost in Delhi in 2025?

For doorstep HP termination, the portal currently shows Government Fee = ₹0 and about ₹50 as doorstep facilitation (including tax). On top of this, there can be RC smart card & postal charges, and any private agent fees if you use an external consultant. Always check the latest fee on the official Delhi Transport site.

How long does it take to get a new RC without hypothecation in Delhi?

In 2025, a clean application usually takes about 10–21 days from submission to RC delivery, depending on RTO workload and postal speeds. If you do not see progress or receive your RC within 30 days, raise an online grievance or visit your Zonal RTO with the application number.

Can my HP removal application be rejected due to missing colour-coded stickers?

The exact wording in the rejection may vary, but after the Supreme Court’s directions and Delhi’s implementation, colour-coded stickers are practically required for issuing vehicle documents like RC and hypothecation updates. In 2025, missing or incorrect stickers can definitely delay or complicate HP termination.

I am selling my Delhi car directly to a buyer in another state. Should I remove HP or apply for NOC first?

Best practice is: clear the loan and remove hypothecation in Delhi first, so the RC shows no HP. Then apply for NOC and complete re-registration in the buyer’s state. This sequence aligns with good documentation practice and reduces disputes about loan status or bank rights after sale.

Is biometric verification mandatory for hypothecation removal in Delhi in 2025?

Yes. Under Delhi Transport’s updated digital process, Aadhaar-based biometric verification is generally required at the time of RC processing or delivery. Without completing biometric confirmation when asked (via SMS/portal link), your HP termination application may not move to approval stage.

What happens if my bank has not updated hypothecation closure in the Delhi VAHAN portal?

This is a common cause of delay in 2025. If your bank or NBFC has not uploaded the digital hypothecation termination, Delhi RTOs (DL01–DL12) may reject or keep your file pending. Push the bank to update Form 35 + NOC online, ask for dispatch/reference numbers and keep a stamped physical NOC (usually valid for 90 days).

Can I apply for HP removal in Delhi if my PUC is expired?

No. Hypothecation removal cannot be processed if PUC is invalid or expired. On VAHAN, you may see an error like “Vehicle PUC invalid/expired — renewal required”. Always renew PUC first before starting the online HP termination process.

Does HP removal affect my ongoing or future driving licence work in Delhi?

HP removal itself is an RC service, but many owners coordinate it with driving licence services for themselves or drivers to keep all documents aligned. If you need help with DL in West Delhi (for example, Janakpuri), services like Driving License in DL04 (Janakpuri, Delhi) from Fateh Legacy can keep both vehicle and driver credentials compliant.